9 Easy Facts About Offshore Banking Explained

Table of ContentsThe Definitive Guide to Offshore BankingThings about Offshore BankingOffshore Banking Fundamentals ExplainedAbout Offshore BankingThe Best Guide To Offshore Banking

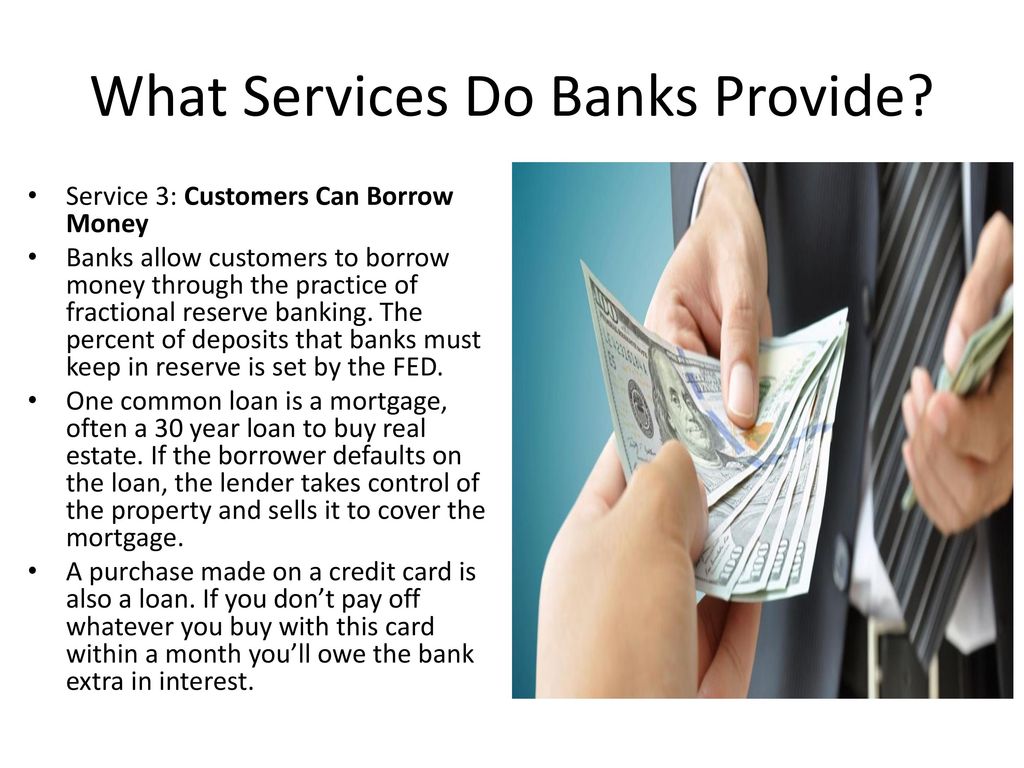

The outlets will need to be open early evenings and on Saturdays. Banks should additionally publish famous signage indicating that the electrical outlets supply check-cashing solutions; offering the electrical outlets a CCO-type name, such as "Money Express Center of Bank X," might serve this purpose. This sort of electrical outlet has three major benefits over a mainstream establishment in regards to its ability to get to the unbanked: By supplying CCO solutions in a financial institution branch, the financial institution establishes straight contact with CCO customers.Others do not desire deposit accounts for fear that their financial savings could be confiscated by lenders or might make them disqualified for welfare. By offering check-cashing services, banks can supply high-grade, fairly affordable settlement services to such people who continue to be beyond the deposit system (offshore banking). Financial institutions with branches in lower-income areas usually report that it is tough to cover the costs of these branches with typical solutions considering that down payment mobilization is reduced, deal degrees are high, and car loan opportunities are limited.

Banks opening such electrical outlets ought to have the ability to set costs for check-cashing solutions that are very competitive with those of most check-cashing electrical outlets and yet moderately profitable for the banks. This holds true for two reasons. The financial institution outlets, which provide typical customer banking solutions as well as check-cashing solutions, need to benefit from economies of extent.

Unknown Facts About Offshore Banking

Second, financial institutions, unlike commercial check-cashing electrical outlets, have straight accessibility to check-clearing systems and also a relatively reduced price of monetary funding. This will certainly get rid of some of the prices that check-cashers sustain from the demand to clear checks through the banking system as well as acquire capital (offshore banking). Along with check-cashing solutions, the outlets ought to offer the full range of consumer banking solutions used at the standard branches of the banks that have them.

A basic remedy is to offer cash orders for much less than $1 each, as do many CCOs and comfort shops. To ensure that money order sales do not tie up bank employees, a bank might automate the dispensing procedure. The electrical outlets must additionally market stamped envelopes in which to send by mail the cash orders and serve as agents for the payment of utility expenses.

The Basic Principles Of Offshore Banking

Several lower-income people have a background of composing checks that bounce or fear that they will create such checks in the future. Such individuals require bank account that can not be overdrawn, however that use an inexpensive as well as convenient methods for making long-distance settlements. In addition to the cost savings account described over, the electrical outlets ought to offer a "savings-building" account, comparable to a typical important site "Xmas Club" account.

This consequently should aid people that must regularly delay paying costs to satisfy their payment obligations in a timely fashion, improving their credit scores backgrounds over time and making them eligible for low-cost sources of debt. There can be several variants in the details of savings-building accounts, but study on consumers' financial savings actions shows that these accounts should have a number of key functions.

The emotional basis of these guidelines is apparent. Individuals have a tough time reducing an optional basis, so they save most properly when the act of cost savings is reasonably unconscious and the cost savings are checked out as "secured away." Although the outlets can compete with commercial check-cashers, for the most part they will certainly not be able to provide standard car loans to people currently obtaining from non-bank high-cost lenders, such as payday financing companies.

Rumored Buzz on Offshore Banking

With credit-scoring as well as various other cost-saving innovations, the outlets may be able to make fast-disbursing small-value lendings with costs that are appealing to both the customers and also the banks. Consumers with impaired credit report will also have legit needs for debt. To assist fulfill this need, the outlets must offer deposit-secured finances to customers unable to pass conventional credit-risk evaluations.

As noted previously, lots of lower-income families without monetary savings encounter periodic financial crises brought on by unanticipated expenditures or disturbances in the their incomes. When such a disruption takes place, the family might not be able to pay its rental fee or repair a cars and truck needed to reach work. This can bring about compounding crises, such as shedding housing or a task.

Fascination About Offshore Banking

The electrical outlets need site here not perform such monetary counseling programs themselves, nonetheless; not just are such programs pricey to offer, yet banks might not be the suitable institutions to supply the information. Community-based companies are most likely to be extra efficient. For one, well-run CBOs will comprehend the particular monetary literacy demands of their neighborhoods and have personnel that can communicate pleasantly with neighborhood members (offshore banking).

Banks may well be interested in carrying out the outreach approach advocated above. Lots of financial institutions presently maintain conventional branches in lower-income locations.